Two for the Price of One: Financial Mastery meets Keystone Habits

Ben Franklin often started his days by standing in front of the bedroom window he left open all night, naked as a jaybird. Look it up. He called it an “air bath”.

Look in this dude’s eyes and try to tell me he didn’t flaunt his Founding Father for the world to see.

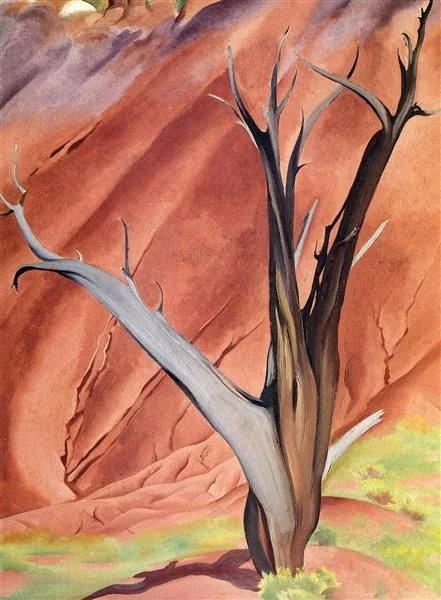

Georgia O’Keeffe painted many of her greatest works sitting in the passenger seat of her Ford Model A, her canvas laying on the back seat as an easel.

Gerald’s Tree, painted by O’Keeffe in 1936 inside of her Model A. Next time I whine about not being able to finish a blogpost because my dining room chair isn’t as comfy as it used to be, I’m going to flog myself over the head with a framed print of it.

Widely accepted as the greatest Greek orator of all time, Demosthenes would shave one side of his head to dissuade himself from going outside, thus ensuring he would hunker down to his studies.

Through the miracle of modern technology, I was able to produce an exact replica of Demosthenes as a young man.

Some of the most impactful, prolific individuals in history had truly bizarre habits. Keystone Habit #4, which also happens to be Step #4 in Getting Your Financial Shit Together is a weird habit I’ve maintained since March 3rd, 2015:

Step #4: Track your net worth and record it every day.

“But what if I don’t want to be obsessed with money like you are?” (In case you hadn’t heard, Facebook’s new privacy policy allows your inner monologue to be broadcast on any site that you visit from your profile)

Surprisingly, one of the best ways to avoid obsessing over something is to think about it every day. The key is that this thinking is done purposefully because it’s part of your plan and your routine. Once it’s done, you don’t think about the topic anymore, except when you want to.

So yes, I think about money each and every morning when I update our account balances and credit card balances in an Excel spreadsheet. But here is what I don’t do:

I don’t overdraw our accounts because I’m intimately familiar with our cash flow.

I don’t pay bills late because I know exactly when they are due and I don’t get surprised about large annual bills like car insurance because I see them coming miles away.

I don’t get worked up about sudden dips in the stock market because I’ve seen countless sizable daily swings in our investments, both upwards and downwards. I’m used to the roller coaster.

I don’t wonder if we’re saving enough. For a while, I knew that we weren’t but knowing that you aren’t and can change is infinitely better than not knowing if you’re putting enough away.

I don’t feel guilty about impulse buys because I understand their impact in the broader picture of our financial health.

I don’t get discouraged and feel like our financial progress has stalled because I watch our investments grow and our mortgage balance shrink month after month.

I don’t worry about money because my daily habit gives me a thorough understanding of all our meaningful financial details.

I don’t greet the sunrise by flashing my next-door neighbor from my bedroom window.

So maybe I’m no Ben Franklin, but you get the point.

Worst case scenario, by implementing this habit you will trade 10 minutes per day to lessen the anxiety you feel about your financial situation.

Best case scenario, this habit will completely change your relationship with money for the better and give you deep peace of mind about a topic that year-in, year-out tops the list of most common causes of stress:

Source: American Psychological Association, Stress in America, 2/4/15

Even if your DadBod isn’t in the financial domain, optimizing your personal finances will go a long way toward supporting your progress and growth in all the other areas of your life. Think of it as maximizing the amount of resources at your disposal.

Let’s start with a definition:

Your Net Worth is equal to the value of your assets minus your liabilities (debts). It’s what you own minus what you owe.

One of the reasons why tracking your net worth is so powerful is that it builds significant momentum toward improving your financial situation. Every time you make a mortgage payment or a student loan payment, your net worth increases. Not only that, it increases by more than it did when you made the last month’s payment.

Similarly, anytime you make a retirement contribution or feed your online savings account or put money into a brokerage account, your net worth increases. When you receive monthly/quarterly/annual dividend payments from the stocks and bonds you own, your net worth increases. If you own property, when the housing market strengthens, your net worth increases.

Tracking your net worth makes progress toward your financial goals visible, no matter what they are.

How exactly you decide to measure your net worth is much less important than the measurement remaining consistent over time. Personal finance geeks like yours truly love to debate whether you should include the value of your belongings, the expected sale price of your home, the cash value of your life insurance, and dozens of other items in your net worth.

None of that matters.

What matters is that you decide what to include and then keep it consistent over time. For instance, if you decide to include the expected sale price of your house, don’t arbitrarily increase it by 10% from one month to the next because you keep hearing “how hot the housing market is”.

For what it’s worth, here are the decisions we made regarding how to calculate our family’s net worth:

Include 100% of 401(k), 403(b), 457(b), Roth IRAs, 529 college savings plans, Vanguard brokerage account, and Ally online savings account balances.

Exclude checking account: We try to keep the balance as low as we can and each month it gets close to $0 when we sweep whatever is left into our brokerage account.

Exclude value of all possessions including cars (primarily because we drive two very old, nearly worthless cars and we don’t want to psychologically reward ourselves for buying stuff which would increase our net worth on paper).

Include 92% of conservative estimate of home sale price to reflect expected 8% loss in realtor fees and other fees upon sale. Update home sale price once/year based on comparable sales.

The easiest way to pull this data together in one place is to use Personal Capital (also highly recommended for expense tracking in Step #1). Once you provide your username and password for your various accounts, you will see a dashboard with your net worth, front and center. It trends the data over time and produces slick graphs that make you (me) feel like a hedge fund manager with an IQ of 175.

Sample Personal Capital dashboard. This isn’t our actual data…or maybe it is :) (It’s not).

Now even though net worth tracking is one of Personal Capital’s best features, I still recommend you also track your daily net worth in a separate file. Similar to tracking your expenses, requiring even a minimal amount of manual work/processing will anchor the data and its importance in your mind.

We are now getting dangerously close to the summit. I know the air is thin up here but solider on! Our next and penultimate step will focus on making sure you are wringing every last drop of financial benefit from your employer.

Remember: The first two habits you should develop are these two. After those are part of your routine, add any Keystone Habit that isn't. They combine to form a synergistic DadBod domination machine, the likes of which few have seen.

Keystone Habit #1: Develop a Gratitude Ritual